Market Update + Q&A, January 2022

See below for our January Market Update + Q&A. Summary points below the video.

Market Update & Q&A Video Summary (January 2022):

00:09 Disclaimer

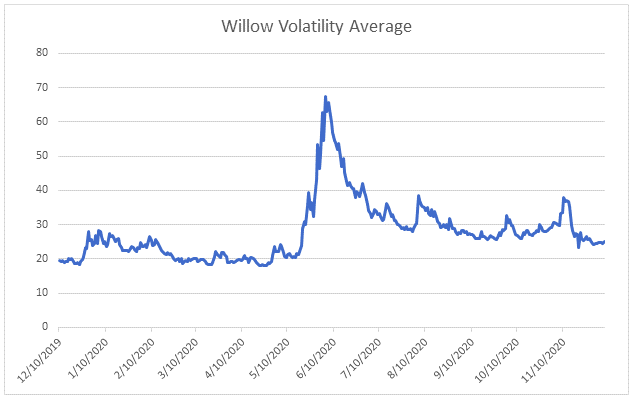

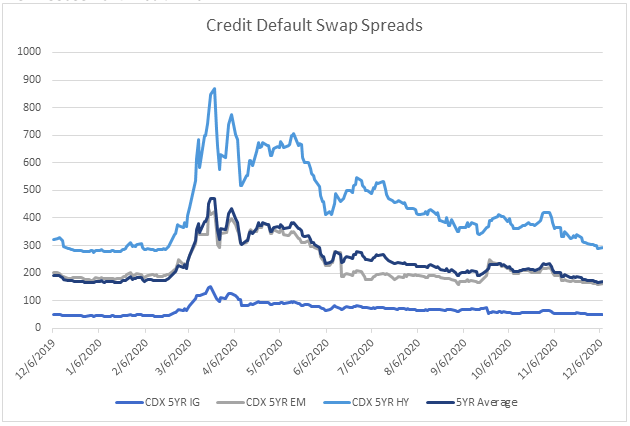

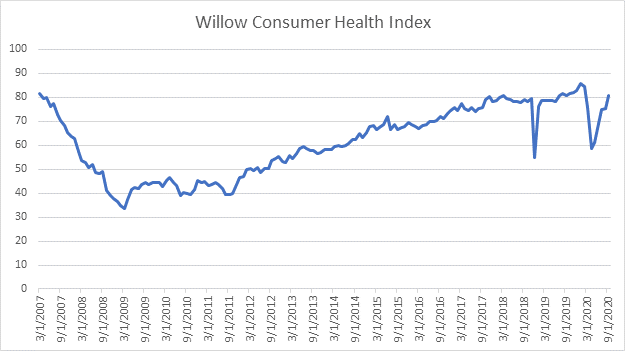

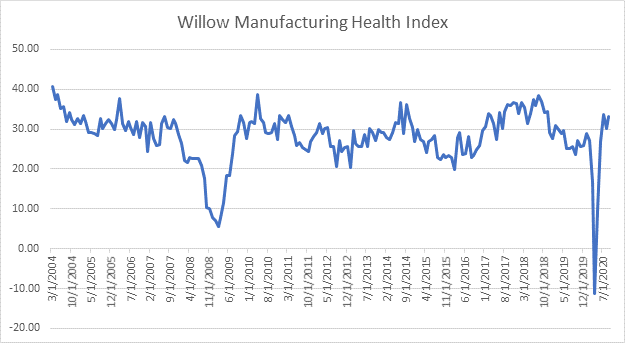

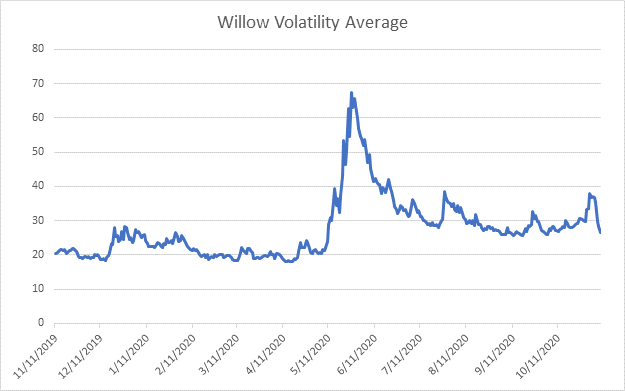

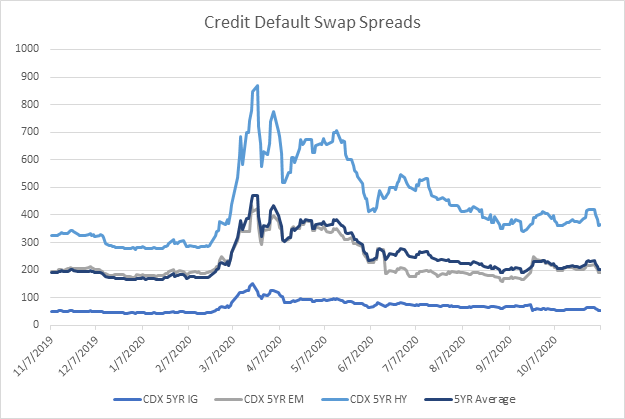

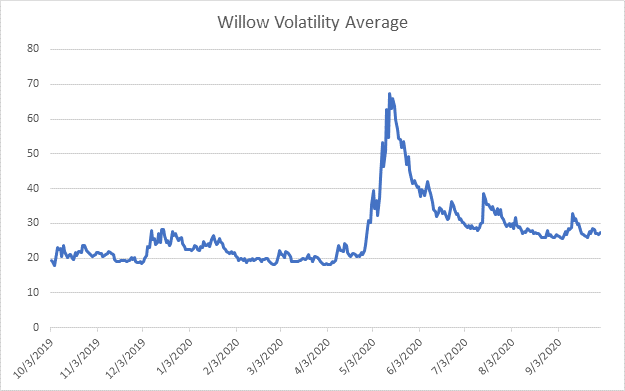

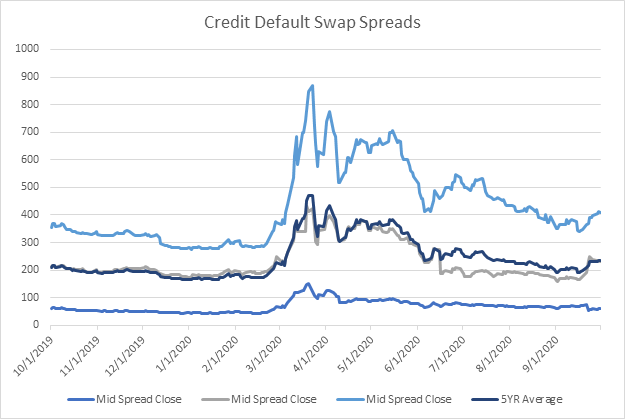

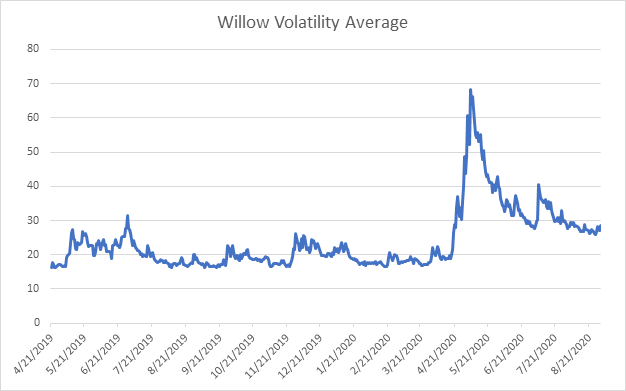

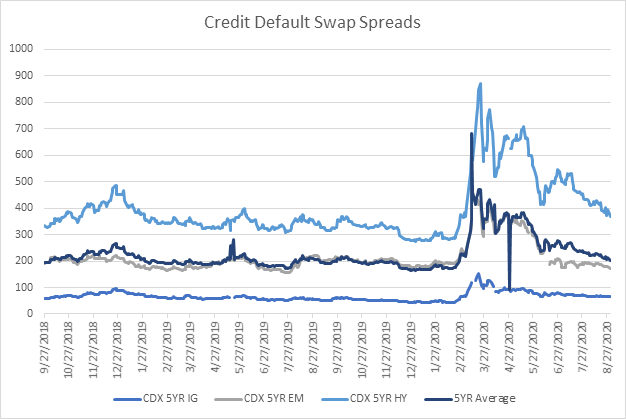

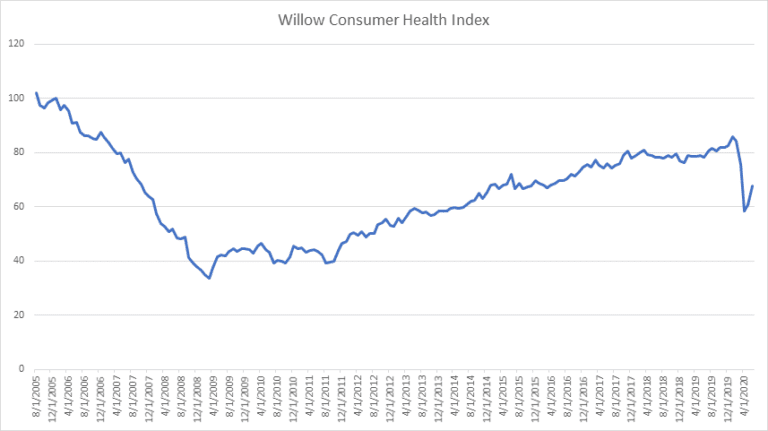

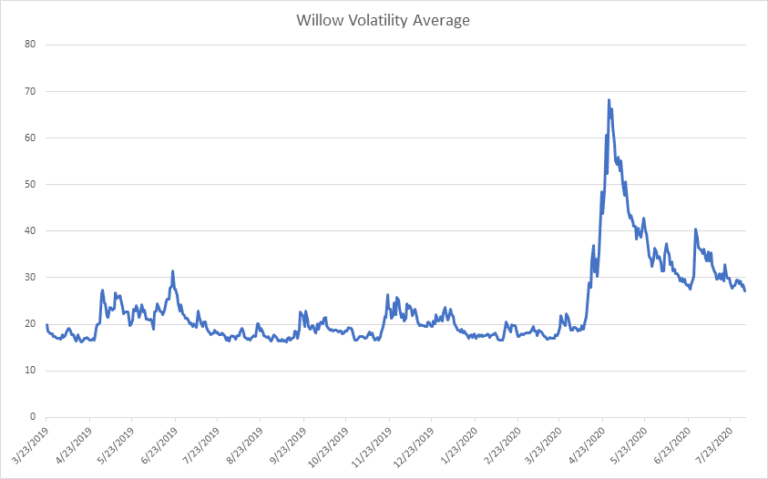

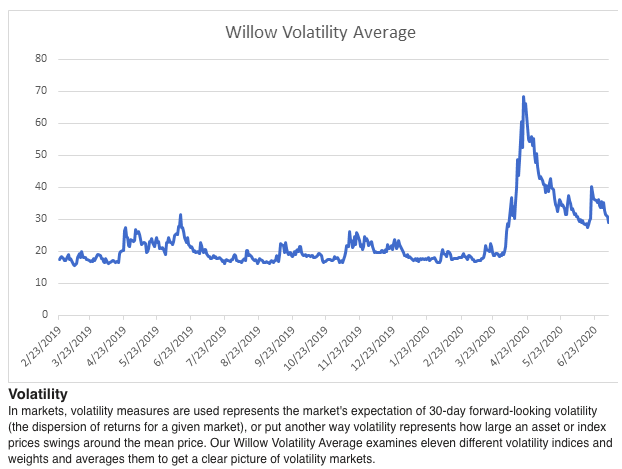

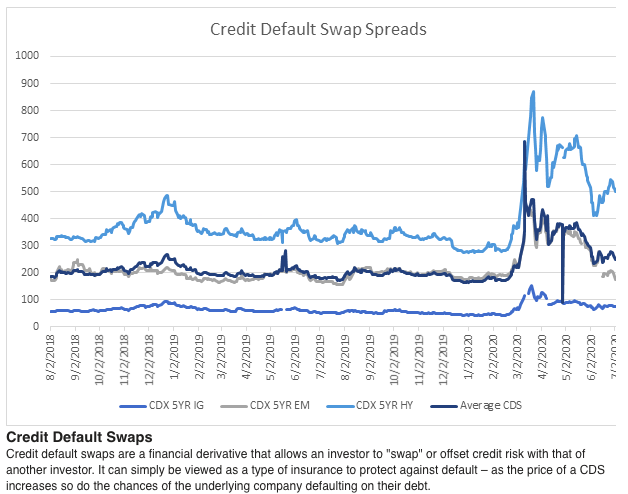

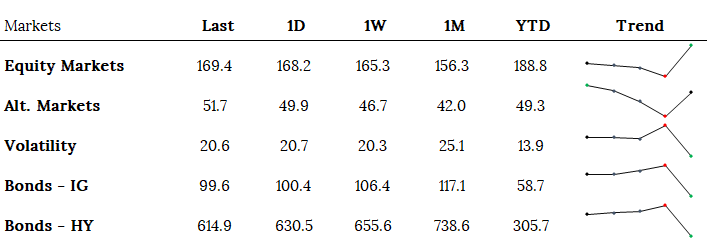

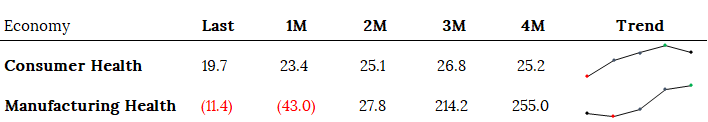

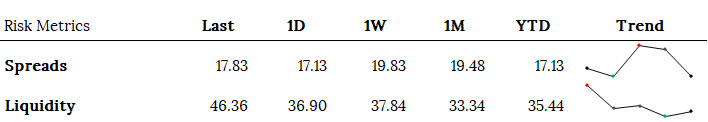

01:41 Risk Indicators – Volatility 02:31 Risk Indicators – CDS Spreads

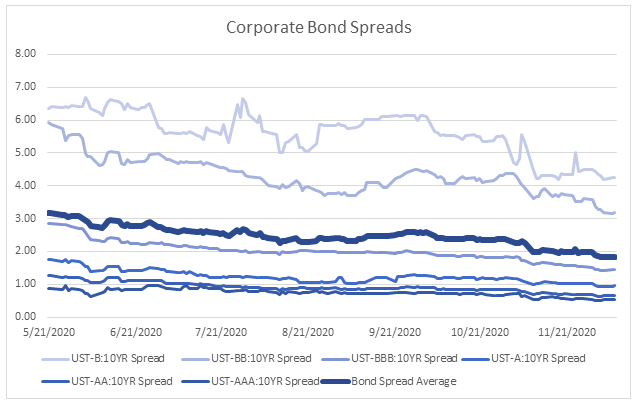

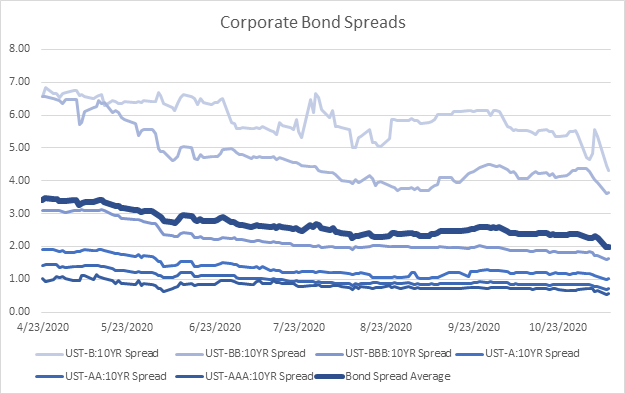

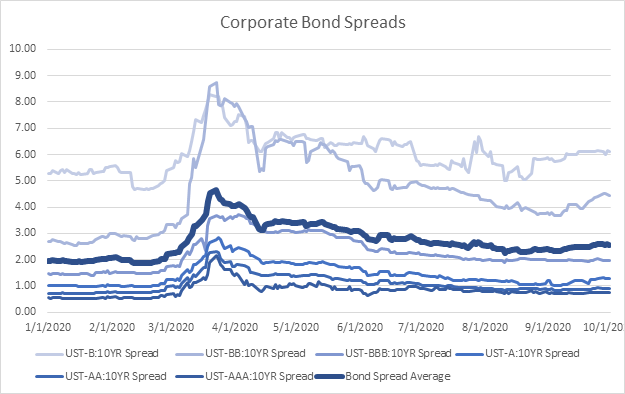

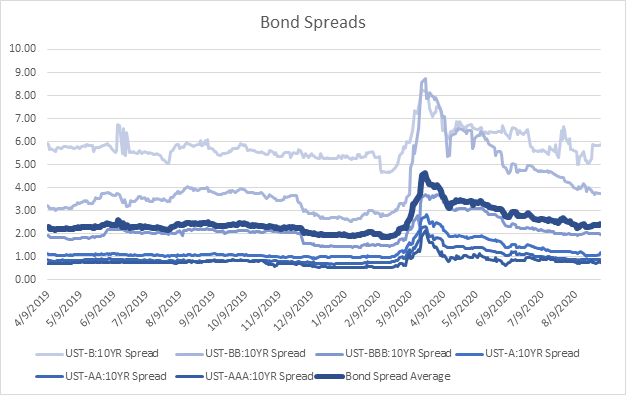

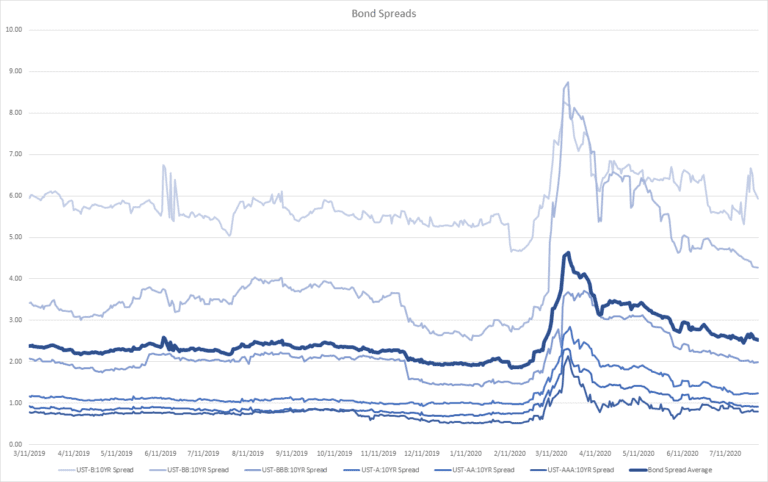

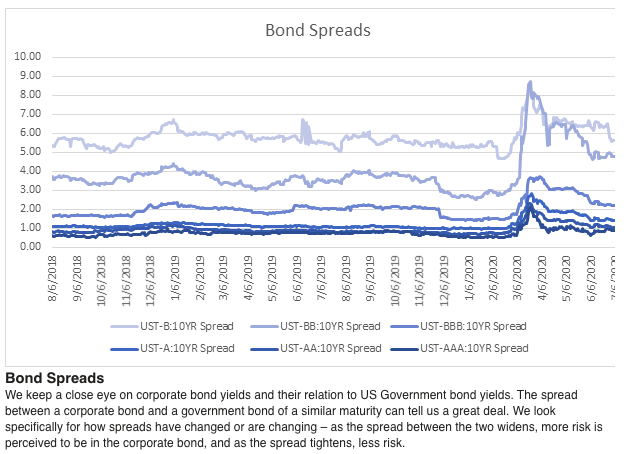

03:15 Risk Indicators – Bond Spreads

04:09 Velocity of Money

05:38 Trade Deficit

07:44 Margin Debt

11:28 Inflation – Transitory or Not?

25:27 Crypto Update – Protocol Revenue

27:37 Crypto Revenue in Perspective

28:49 Creator Economy

34:17 DeFi Q+A

36:03 Q: How would you use crypto as a currency – stable coins?

37:15 Q: Inflation, Labor, Supply Problems – building Cash in Positions

37:41 Q: Do you feel that emerging markets are underinvested?

39:10 Q: Where do you see the greatest risk in opportunities in the year ahead?

40:30 Q: In an unpredictable world do you bet on using cash positions to invest in growth stocks?

43:19 Q: Questions on various Stocks

To set up a meeting, please click here or give us a call.

Best regards,

The Willow Team

+1 413 236 2980