Dear Clients & friends –

We are kicking off a new monthly newsletter where we share our current thoughts on markets and risk in an effort to provide some insight to our thinking, the metrics we pay attention to, and to lend some insight into what you are seeing and hearing in the news. We hope you enjoy, and please let us know if there is anything you would like us to go into more detail on, we welcome your feedback!

The numbers shown below are weighted averages and aggregates of the daily data we examine. They are used for illustrative purposes only. please see our disclaimers at the bottom of this email for more information or feel free to contact us directly.

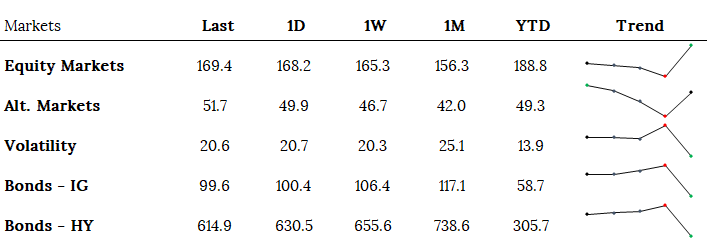

Markets

S&P 3000 is a key level for several reason – it’s a psychological level (who doesn’t love round numbers?), it’s right at the 200 day moving average (a key technical level), and it’s right above the 61.8% Fibonacci retracement level, which, with sustained pressure can typically signal a continued rally. All in all, markets are about 40% off their March lows. Sounds great, right? But is it? With market breadth so slim, very few companies are participating in this rally. We stand firm by the thought that a violent drop would be accompanied by an equally violent rally – the question that remains – is this a “V” recover or simply the establishment of a “lower high” in a broader forming down trend that’s just starting to realizing the global economic disruption currently happening? That said, don’t discount the Fed, as the perception of back stopping any downside risk gets more and more believed a rally unhinged becomes a reality. But with millions unemployed, supply chains disrupted, and the future increasingly uncertain, do fundamentals mater anymore? Will they eventually catch up? That’s why we watch the data.

Alternative markets like gold and bitcoin are looking decent. The former a traditional hedge, the later a potential alternative future, we believe strength in these markets could also be a proxy for faith in today’s equities markets. The fundamental case of limited supply assets vs. unlimited “whatever it takes” fiat will play out interestingly and possibly historically given current conditions – we’ll see.

While volatility has backed off considerably it remains are an elevated level, still over twice what it was at the beginning of the year. We would like to see these level much lower to really be confident in equity markets. But declining volatility metrics lessen the probability of continued large price swings.

Spreads across the board on both investment and high yield corporate bonds have tightened, same with credit default swaps. This is a positive sign signaling lower overall perceived risk in defaults. While levels are still elevated, they are moving in the right direction.

Risk Assessment: Medium. Watch the technicals, participation levels, and volume – a select few companies can only drive markets so much higher before they lose their fuel. Cryptocurrencies in general are looking very interesting, and do not underestimate the influence of the Fed and central banks on markets. While there are some very apparent cracks in the building, the simple belief that the Fed will save us should anything happen will keep it standing… for now anyway.

Economy

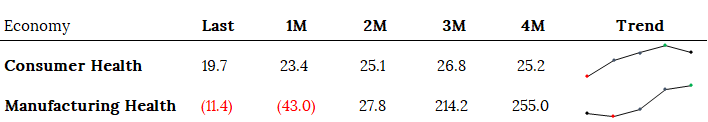

The consumer (~70% of the economy) continues to get beaten up as economic data continues to roll in. While most of this is expected, the numbers posting in many cases are never before seen. It took over a decade to build up as many jobs that were lost in a few months. It will be critical to see how this plays out and how quickly (or if) the measures of consumer health recover. Manufacturing (~11% of the economy) has experienced some relief recently as lock downs are being lifted but again some of these data points are screaming all is not well and are sitting at never before seen level.

Risk Assessment: Medium/High. While the data is bad, and that is expected, the speed and strength of how it resolves will be the determining factor for what comes next. Right now, this is a huge unknown. Remember markets and economy should be viewed as two very different entities.

Risk Metrics

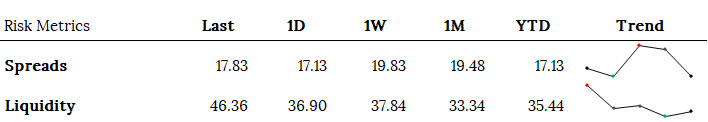

Spreads versus US treasuries have for the most part tightened or are at least near levels they were at during the beginning of the year. This is generally a positive sign leaning toward some return to the perception of lower market risk. While liquidity has returned to markets compared to March levels, our signals are starting to show growing issues in this space, the numbers are not concerning yet but at this stage it’s worth noting and paying attention too.

Risk Assessment: Medium/Low. Most of our risk spreads have come in, which is positive, but remain elevated, not so positive. Cash and liquidity issues have been reined in but it does not look like we are out of the woods yet.

As always, be well and please feel free to reach out with any questions, comments, or concerns.

Best regards,

The Willow Team

+1 413 236 2980

ADCM, LLC dba Willow does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although the information contained herein has been obtained from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities.