Willow Risk Monitor October 2020

Welcome to the October 2020 overview edition of the Willow Risk Monitor, where we share our analysis of the level of risk in the current market across a variety of metrics. We also explain our thinking on how we look at and assess overall market risk, and we will often highlight what the data shows compared to what you might be hearing in the news.

At Willow, risk management is one of our key influencers in creating portfolio strategies for our clients. We hope this gives a peek into our investment management window.

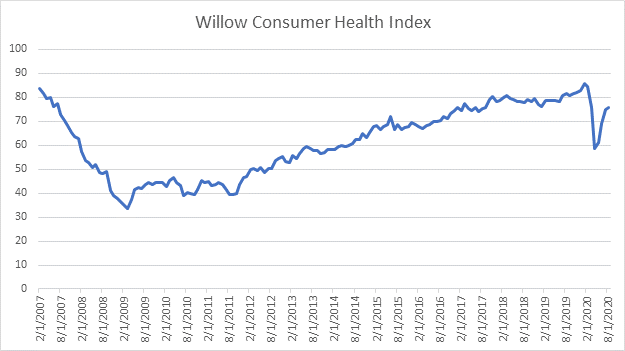

Consumer Health (proprietary algorithm)

Coming off the forced shut down, high wage earners (those making over $60k/yr) employment levels are almost back to pre-COVID levels (-12% to -1%, from April to September) while low wage workers (those making under $27k/yr) have only recovered half as much (-36% to -16%, from April to September). Arguably this cohort has less spending power, so even though the facts on the ground are sobering the economic impact is lessened. Unemployment claims have leveled off in the 800k range (which is still round 4x the average). But consumer sentiment, expectations, and spending have been rising steadily, home sales have been strong, and productivity has jumped – all positive tail winds.

Risk Assessment: Medium/Low

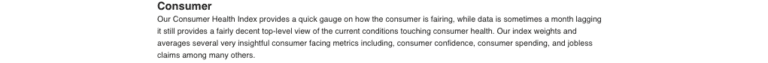

Manufacturing Health (proprietary algorithm)

Our manufacturing health index is back to pre-covid levels, but we still reserve some caution here. Forced shutdowns in the manufacturing sector have been generally lifted so numbers should continue to come in strong in response as pent up demand releases. Many manufacturing based indicators are at or above pre-COVID levels (business confidence, durable goods, and most regional manufacturing indices), industrial production has lagged but new orders continue to rise.

Risk Assessment: Low

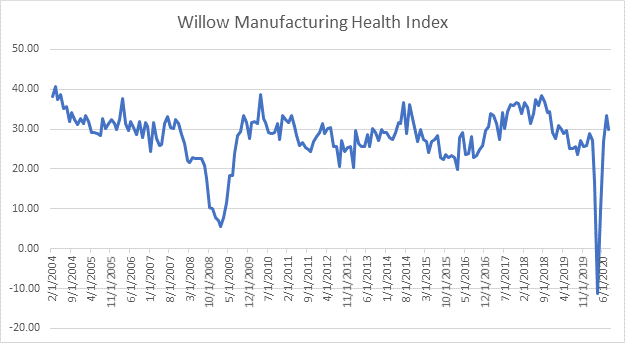

Market Volatility (proprietary algorithm)

Volatility (the implied forward-looking move in markets) bottomed out in August and has slowly been creeping back up. This is most likely due to election jitters.

Risk Assessment: Medium

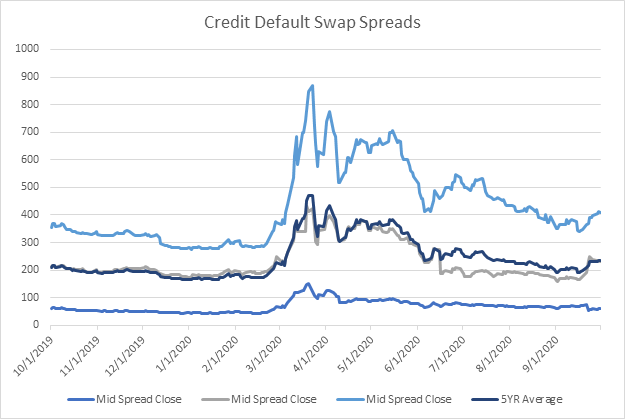

Credit Default Swaps

Credit default swap spread have been rising. This is worth paying attention to as it signals that credit protection is getting more expensive. This happens when the perception shifts to believe that the underlying companies are more risky, more likely to default, or more likely to not meet their debt obligations going forward. While not extraordinarily high, levels have been rising since August and have yet to return to pre-2020 levels.

Risk Assessment: Medium

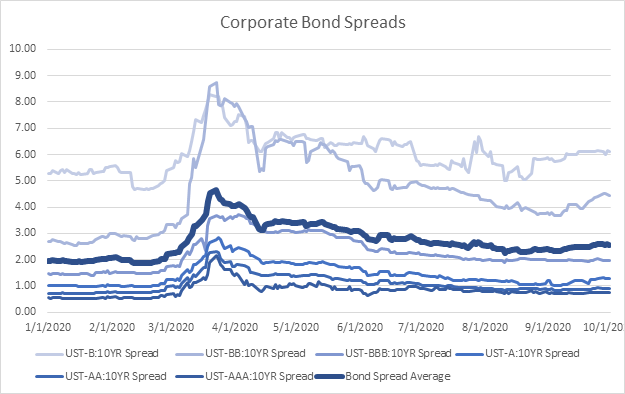

Bond Spreads

Corporate bond spreads have been widening slightly. Most notable are the moves in A rated and BB rated corporate bonds which have pushed the average spread higher. Again, the higher the spreads the higher perceived risk in the underlying companies issuing the bonds. As these are investment grades that have their spreads widening it is worth noting. One reason could be the recent uptick in furloughs and layoffs.

Risk Assessment: Medium/Low

As always, be well and please feel free to reach out with any questions, comments or concerns.

Best regards,

The Willow Team

+1 413 236 2980

ADCM, LLC dba Willow does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although the information contained herein has been obtained from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities.