Willow Risk Monitor August 2020

Welcome to the August 2020 overview edition of the Willow Risk Monitor, where we share our analysis of the level of risk in the current market across a variety of metrics. We also explain our thinking on how we look at and assess overall market risk, and we will often highlight what the data shows compared to what you might be hearing in the news.

Please contact us if you have any questions or if there is something you’d like more detail about. We welcome your feedback!

To learn more about the premium version of the Willow Risk Monitor, click here.

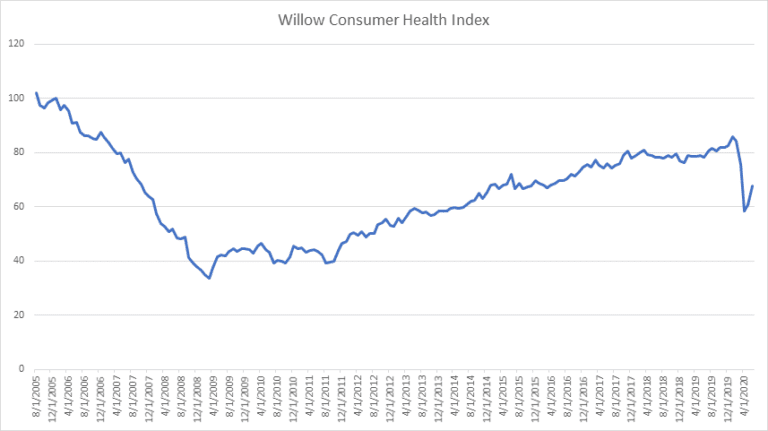

Consumer Health (proprietary algorithm)

While there clearly was a rebound from the lows, our indicators are pointing to a “recovery” that is not nearly as strong as main stream news would have you believe. This is mostly due to a lack of recovery in metrics tracking consumer confidence and a leveling of unemployment data at high levels than expected.especially small businesses, are not expecting to rehire everyone they lost.

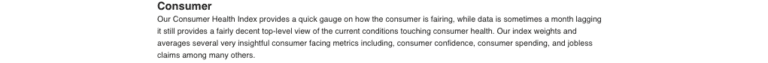

Manufacturing Health (proprietary algorithm)

While the bounce back in manufacturing looks impressive and as if there has been a return to normal, it’s important to dig into the data on this one. As expected, prints on manufacturing data that took a huge hit in March have rebounded sharply. But when looking at the individual metrics, capacity utilization is lagging in a noticeable way. We believe this will take some time to play out but the reduction in capacity utilization (which tracks the amount of national production capacity that is currently being used) will begin impacting things like factory orders, this data can take some time to show up. We recommend watching this closely to see how broad the recovery actually is, and if the big number rebound prints where just the natural response to the preceding massive drop off.increased automation… the list of items poking this sector is long…

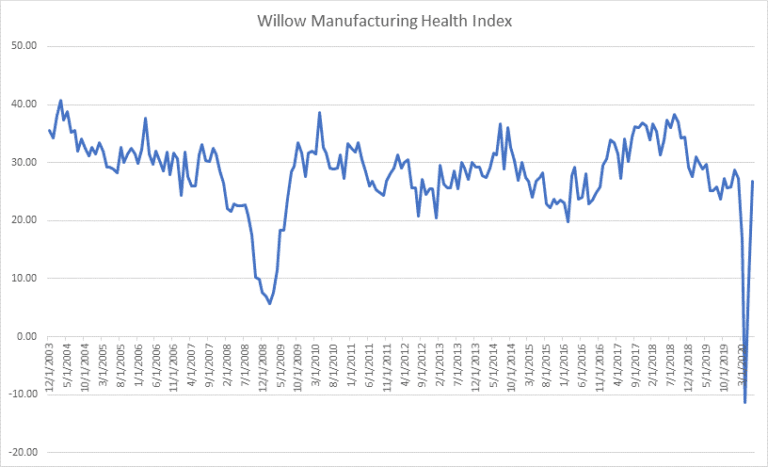

Market Volatility (proprietary algorithm)

Volatility, or the implied move in market prices for the next 30 days has found a support level in our Willow Volatility Average chart around the 27-29 level. A break lower would signify less implied risk in markets, while a move high, the opposite. We consider this a key area to watch as since April, volatility has tightened at a rapid pace but has appeared to bottom out since June. Again, we value the velocity of the curve more than the actual number and this curve is telling us that uncertainty remains.

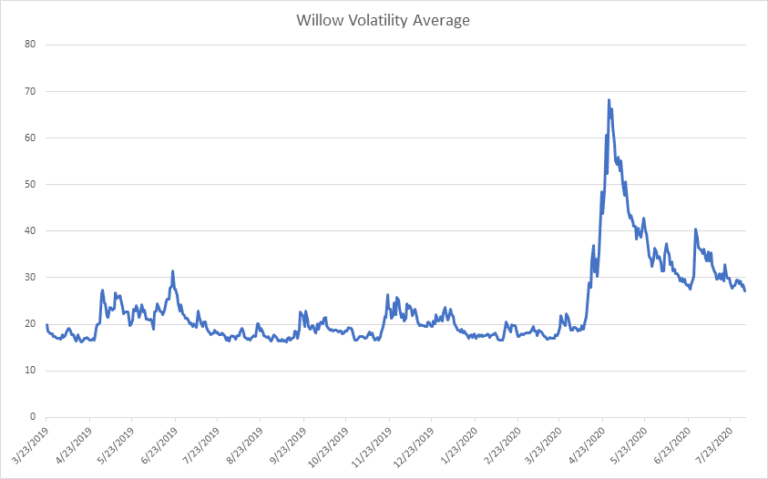

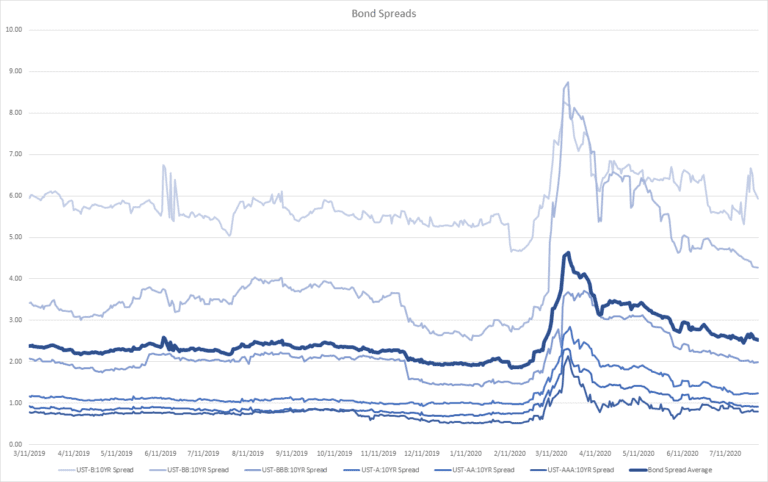

Bond Spreads

Overall bond spreads have tightened which is in general a sign of lower overall risk. While early, and potentially still forming, what is noteworthy this month is that on the investment grade side, spreads have flattened and returned to pre-corona virus levels. At the same time high yield bond spreads still remain elevated comparatively. What does it mean? There are a few conclusions that can be drawn:

Investment grade bond markets believe that having backing of the Federal Reserve removes a large portion of risk from this tranche, and;

High yield bonds, while receiving some support from the Fed, are still more prone to bankruptcies, which is why spreads remain elevated compared to longer term averages.

Watch the investment grade bond spreads side closely – while levels have flattened, small upticks in A rated bonds may be signaling concerns over bankruptcies impacting these bonds.

As always, be well and please feel free to reach out with any questions, comments or concerns.

Best regards,

The Willow Team

+1 413 236 2980

ADCM, LLC dba Willow does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although the information contained herein has been obtained from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities.