Willow Risk Monitor December 2020

Welcome to the December 2020 overview edition of the Willow Risk Monitor, where we share our analysis of the level of risk in the current market across a variety of metrics. We also explain our thinking on how we look at and assess overall market risk, and we will often highlight what the data shows compared to what you might be hearing in the news.

At Willow, risk management is one of our key influencers in creating portfolio strategies for our clients. We hope this gives a peek into our investment management window.

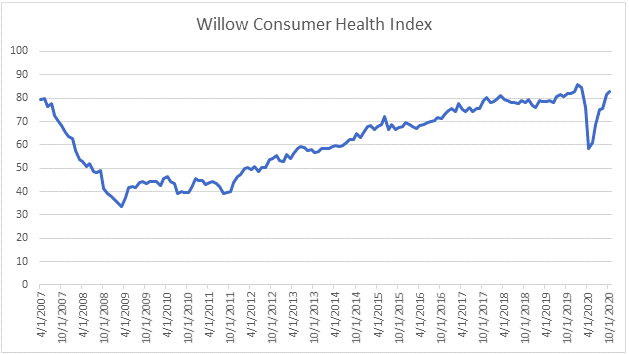

Consumer Health (proprietary algorithm)

Again, overall, the metrics measuring consumer health continue to improve. What the above chart does not show is the reality for lower wage earners as they have a much lower impact on the data being collected to measure consumer health (home buying/building, retail sales, consumer credit, and confidence surveys tend to under represent lower wage earners).

Risk Assessment: Medium/Low

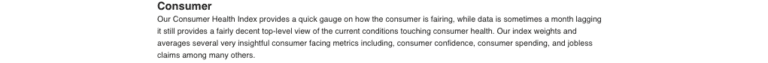

Manufacturing Health (proprietary algorithm)

Removing February and March from this chart and you wouldn’t know the world fell into a health crisis that shook supply chains and is still wreaking havoc. Data here continues to come in pretty good or at least in line with the past decades average.

Risk Assessment: Medium/Low

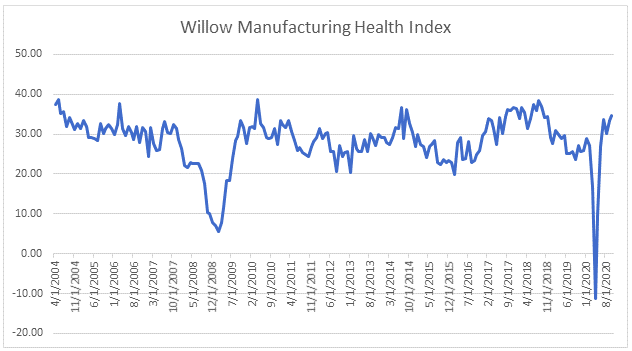

Market Volatility (proprietary algorithm)

Volatility has come down considerably from its peak earlier in the year. While the trend is positive, the velocity, or rate of change, has slowed significantly. Markets are pricing in volatility risk higher than at the start of the year but in relative terms not by that much.

Risk Assessment: Medium/Low

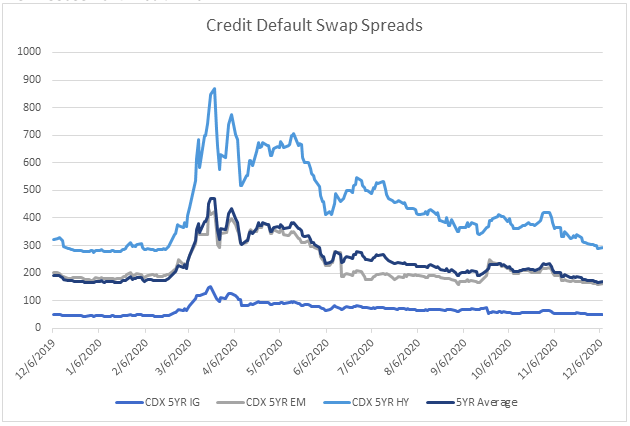

Credit Default Swaps

Not much has changed here since last month. CDS spreads, the cost of credit protection, have had a bumpy ride but spreads have mainly returned to pre-COVID levels. Credit protection isn’t cheap but it isn’t expensive either.

Risk Assessment: Low

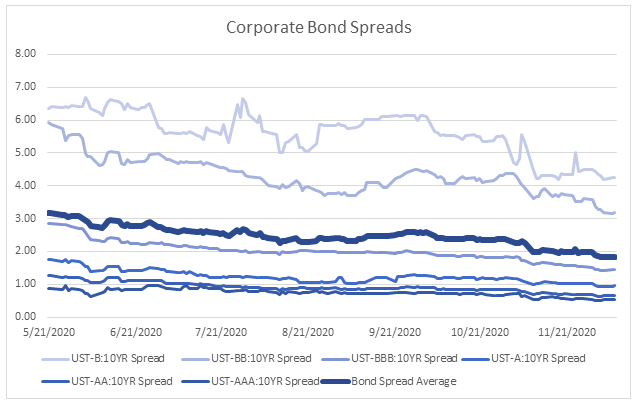

Bond Spreads

Overall bond spreads have continued to tighten in aggregate signaling lower perceived risk in the debt markets. Worth noting is the highest tier of credit we monitor (AAA) and the much riskier BBB tier have both basically flatlined for the past month.

Risk Assessment: Low

As always, be well and please feel free to reach out with any questions, comments or concerns.

Best regards,

The Willow Team

+1 413 236 2980

ADCM, LLC dba Willow does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although the information contained herein has been obtained from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities.