Would you like to get this newsletter right in your inbox every Monday? Sign up below!

Insights for the conscious investor.

|

Social Enterprise: Don’t doubt human ingenuity.

The city of San Francisco just passed an ‘Overpaid Executive Tax’, which adds a 0.1% tax on companies whose executives earn 100 times more than the average worker (nbc)

How to run a successful business while elevating humanity (inc)

Seven emerging issues that will shape sustainable business (thefastforward)

- How working from home could revitalize rust belt cities (theconversation)

Markets & Finance: Make the irrational, rational.

Why financial advisors should care about Bitcoin (coinbase)

World’s largest banks invested more than $2.6 trillion in sectors causing biodiversity loss and wildlife destruction in 2019 (triplepundit)

How economically damaging could new lockdowns be? (economist)

- Necessity plus opportunity yield fastest growth of US new business applications since 2007 (wsj)

Social Consciousness: A humanity revolution.

Podcast: How to Succeed by Being Authentic (Hint: Carefully) (Ep. 438) (freakonomics)

Does being an ethical consumer go far enough? (atmos.earth)

- Policymakers turning to Indigenous leaders for their knowledge of burning techniques that stop the spread of wildfires (nytimes)

Time for Renewables: Unlimited possibility; the good, the bad, the transformative.

New advances in solar energy technology include floating solar farms and infrared night panels (asme)

World first: Dutch brewery burns iron as a clean, recyclable fuel (newatlas)

New plan charts path to zero-carbon US economy by 2050 (triplepundit)

Green Hydrogen: Could It Be Key to a Carbon-Free Economy? (yale360)

- 100% solar, wind and batteries is just the start — the ‘super’ power they produce will change the world (utilitydrive)

Would you like to get this newsletter right in your inbox every Monday? Sign up below!

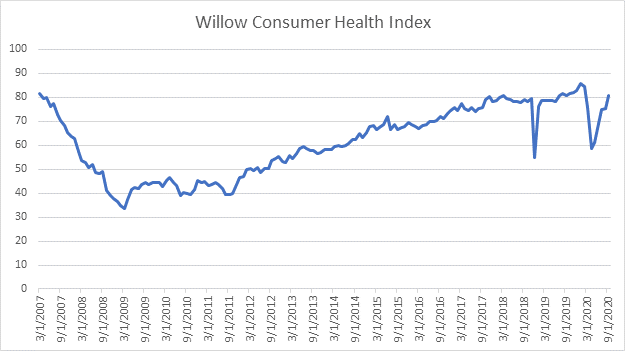

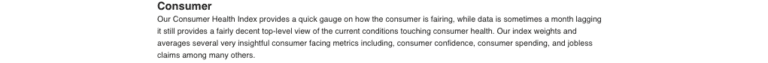

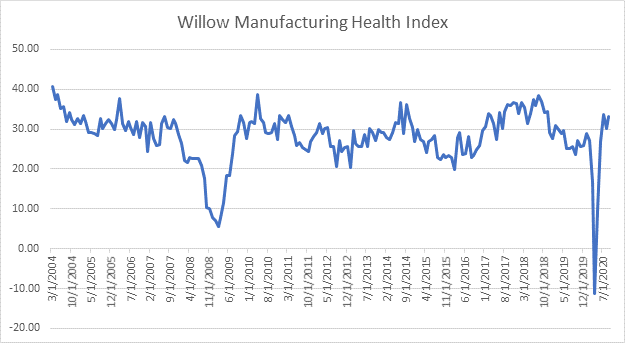

This newsletter is curated by professional financial advisors, wealth managers and market researchers at Willow Investments for Loving Change. We sift through the daily noise to find nuggets of emerging trends and developments in our ever-changing world, focusing on the intersection of capitalism, consciousness and social & environmental justice. How these worlds converge directs the course of our future. One way we can make loving change is to share what we are discovering.

Share this on social media using the buttons below.