Would you like to get this newsletter right in your inbox every Monday? Sign up below!

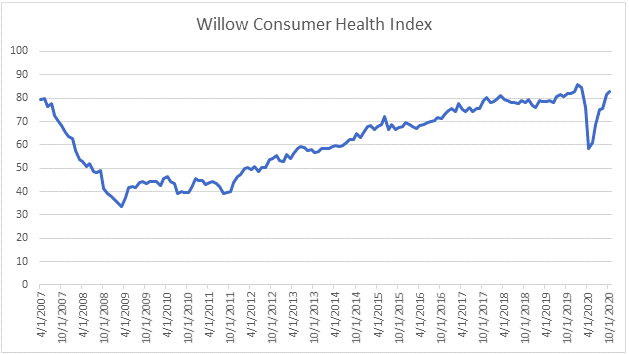

Insights for the conscious investor.

January 19, 2021

Markets & Economy.

- Public and private sector payroll jobs during presidential terms (caculatedrisk)

- China’s national emissions trading may launch in mid-2021 (reuters)

- Weighing the week ahead: what will Biden proposals mean for investors? (dashofinsight)

- Weekly macro summary (primarydealer)

- The periodic table of commodity returns 2021 edition (visualcapitalist)

Cryptocurrencies, digital currencies, and the future of money.

Technology.

- The moderation war is coming (onezero)

Environment.

- We need to talk about the rapid decline in insects around the world (sciencealert)

- Donors pledge $14 bln for ‘green wall’ to hold back Sahara (tribuneindia)

- “Cautious optimism” about fighting climate change (salon)

- The plan to build a global network of floating power stations (wired)

- Why it’s falling to you and not your government to decarbonize the food system (forbes)

- 2020 smashed the record for billion-dollar weather and climate disasters, NOAA says (cnn)

Would you like to get this newsletter right in your inbox every Monday? Sign up below!

This newsletter is curated by professional financial advisors, wealth managers, and market researchers at Willow. We aim to bring attention to the emerging trends and developments in our ever-changing world, focusing on the intersection of capitalism, social consciousness, and environmental justice. How these worlds converge directs the course of our future. One way we can make loving change is to share what we are discovering.

Share this on social media using the buttons below.