Would you like to get this newsletter right in your inbox every Monday? Sign up below!

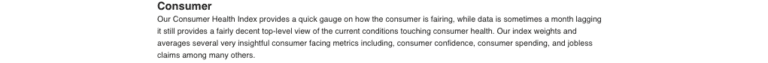

Insights for the conscious investor.

|

A personal note from the Green Matters Team at Willow,

Thank you sincerely for joining us this year as we shared with you some of the headlines that caught our eyes, informed the trends we see developing, and kept us all conscious as investors.

As we move into 2021, we would love your feedback so we can continue to deliver thoughtful and insightful content to you. Please complete this short survey and we’ll mail you a Willow canvas bag!

For our last newsletter of 2020 we wanted to keep it light and share a guided meditation from the Willow Team. Wishing you a happy, healthy new year!

Meditation: Breath in, smile, now let it go.

A guided mediation for loving change from the Willow team [20 min] (youtube)

2020: What at year…

7 wins that gave us hope for the environment in 2020 (natgeo)

A look at the remarkable women+ who made 2020 (ellevest)

- Around the world, people yearn for significant change rather than a return to a “pre-COVID normal” (ipsos)

Carbonomics: The real emerging market.

Companies taking strong climate action rose 46% this year (bloomberg)

- Japan adopts green growth plan to go carbon free by 2050 (ABC)

Trends: Shifting like the weather.

Food futurology: How will we be eating 10 years from now?(foodnavigator)

Firms want to adjust supply chains post-pandemic, but changes take time (wsj)

- Each new generation has a harder time overcoming the wealth of their parents (vocal)

Blockchain: The digital push forward continues.

Why blockchain is the solution to sustainable energy (medium)

Would you like to get this newsletter right in your inbox every Monday? Sign up below!

This newsletter is curated by professional financial advisors, wealth managers and market researchers at Willow Investments for Loving Change. We sift through the daily noise to find nuggets of emerging trends and developments in our ever-changing world, focusing on the intersection of capitalism, consciousness and social & environmental justice. How these worlds converge directs the course of our future. One way we can make loving change is to share what we are discovering.

Share this on social media using the buttons below.