Would you like to get this newsletter right in your inbox every Monday? Sign up below!

Insights for the conscious investor.

|

Solutions: Don’t doubt human ingenuity.

Humanity is stuck in short-term thinking. Here’s how we escape. (mit)

Is tech the solution to a planet in peril? (triplepundit)

Could biological batteries from the ground be our next source of renewable energy? (fastcompany)

Four-day work week is a necessary part of human progress – here’s a plan to make it happen (theconversation)

Focusing on rivers could prevent 90% of ocean plastic (cnn)

Markets & Economy: Make the irrational, rational.

Epic S&P 500 rally is powered by assets you can’t see or touch (msm)

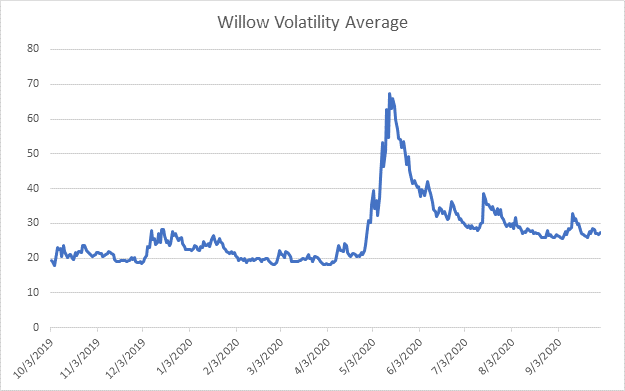

Investors may need to become more comfortable with volatility in their portfolios (awealthofcommonsense)

Economic downturn? These sectors are innovating climate solutions. And they’re thriving. (grist)

Climate, not elections, will move markets soon (bloomberg)

US (65%) lagging rest of the world in adopting ESG investment strategies (94% – Europe, 89% – Canada, 72% – Asia) (forbes)

Crypto & Digital Currency: A digital revolution.

PayPal to allow cryptocurrency buying, selling and shopping on its network (reuters)

China’s digital yuan tests leap forward in Shenzhen (techcrunch)

Commodities Chairman Heath Tarbert talks ethereum, defi and the next bitmex (coindesk)

Bitcoin investment thesis; Bitcoin’s role as an alternative investment (fidelity)

Fed’s Powell: More important for U.S. to get digital currency right than be first (investing)

Robots & AI: Oh My!

Defense official calls Artificial Intelligence the new oil (defense.gov)

Artificial Intelligence: By 2070, robotic judges will analyze body language to pin guilt (dailyalts)

The deepfake apocalypse never came. But cheapfakes are everywhere. (mashable)

Machines to ‘do half of all work tasks by 2025’ (bbc)

Robots encroach on up to 800 million jobs around the world (bloomberg)

Would you like to get this newsletter right in your inbox every Monday? Sign up below!

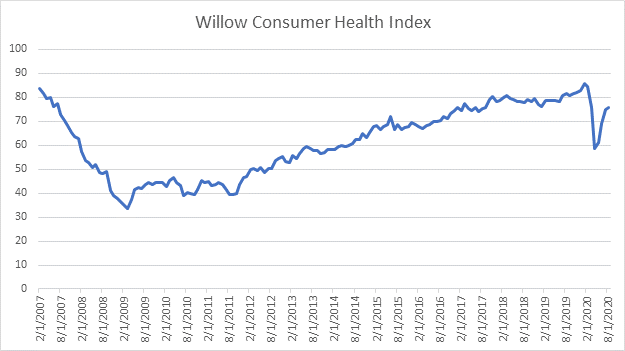

This newsletter is curated by professional financial advisors, wealth managers and market researchers at Willow Investments for Loving Change. We sift through the daily noise to find nuggets of emerging trends and developments in our ever-changing world, focusing on the intersection of capitalism, consciousness and social & environmental justice. How these worlds converge directs the course of our future. One way we can make loving change is to share what we are discovering. www.investwithwillow.com

Disclaimer: Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities. This newsletter is for general informational purposes only. All information is provided in good faith, however we make no guarantee regarding the accuracy of any information contained herein. Please review our Privacy Policy, Disclaimer and Terms of Use & Conditions for more information.

Share this on social media using the buttons below.