Would you like to get this newsletter right in your inbox every Monday? Sign up below!

Insights for the conscious investor.

August 31, 2020

Markets & Economy: The dismal science.

Eight high frequency indicators for the economy (CalculatedRisk)

Putting the economic recovery into contex (Big Pitcture)

Stock Market performance by president (SeekingAlpha)

The financialization of all the things (Medium)

China’s days as world’s factory are over, iPhone maker says (MSN)

Going public circa 2020; Door #3: the SPAC (AboveTheCrowd)

Trends by Generation: Greatest transfer of wealth, happening before our eyes.

Coming population & demographic changes (BBC)

The workforce is about to change dramatically (Atlantic)

The city, an exodus (JamesAltucher)

The pandemic poised to have biggest long-term impact on Millennials’ wealth than other generations. (Wall Street Journal)

Small Business: The life blood of our economy.

Why are local governments paying Amazon to destroy Main Street? (Fortune)

Small businesses are dying by the thousands — and no one Is tracking the carnage (Bloomberg)

Retail stores reborn as micro-e-commerce warehouses (WSJ)

More businesses were lost in the last 3 months than all of the Great Recession, disproportionally affecting blacks, latinx, and immigrant owned (Axios)

Cryptocurrency: A digital revolution.

Bitcoin and Ethereum are a new paradigm for how humans organize and coordinate (Bankless)

US Postal Service, blockchain patent (USPS)

Total value locked in decentralized finance tripled in a month (CodeFi)

Stablecoin (backed by reserve currency) Index: $16 Billion (StableCoinIndex)

Carbon, Climate & the Environment: The not so silent crisis.

The plan to turn half the world into a reserve for nature (BBC)

The simple economics of saving the Amazon rainforest (Freakonomics)

AI to track world’s emissions in almost real-time (Fast Company)

Climate Change poses ‘systemic threat’ to the economy, big investors warn (NYT)

How and why systemic racism harms the environment (TRF)

Solutions: Don’t doubt human ingenuity.

Though forests burn, trees retake farmland globally as agroforestry advances (MongaBay)

Repairing the world in 10 years with $10 trillion global stimulus (World Economic Forum study & proposal) (TriplePundit)

Confronting the Climate Crisis.“It’s about the inherent conflict between capitalism and environmentalism–and how we must de-couple corporate self-interest from the public good.” (Richroll)

Odd Lots: A little bit of this, a little bit of that, a little bit of ohhh that’s interesting…

- ‘Beeing’ in the city (ScienceDaily)

Innovation by Design awards for social good (FastCompany)

- It’s time to redefine what sustainable fishing means: Hundreds of thousands of marine mammals are killed each year by fishing gear. Is this “sustainable?” (Oceans)

Would you like to get this newsletter right in your inbox every Monday? Sign up below!

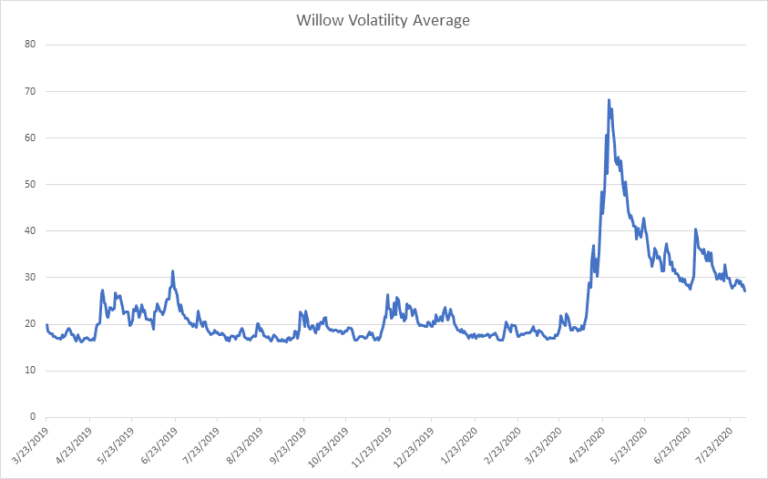

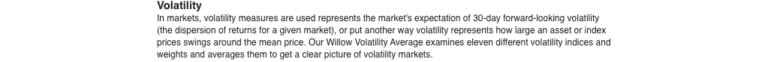

This newsletter is curated by professional financial advisors, wealth managers and market researchers at Willow Investments for Loving Change. We sift through the daily noise to find nuggets of emerging trends and developments in our ever-changing world, focusing on the intersection of capitalism, consciousness and social & environmental justice. How these worlds converge directs the course of our future. One way we can make loving change is to share what we are discovering. www.investwithwillow.com

Disclaimer: Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities. This newsletter is for general informational purposes only. All information is provided in good faith, however we make no guarantee regarding the accuracy of any information contained herein. Please review our Privacy Policy, Disclaimer and Terms of Use & Conditions for more information.

Share this on social media using the buttons below.