June 2020

Alexandra and Paul reflect on the market and economy over the last month and share highlights, analysis and outlook of market risk indicators and economic conditions.

Play Video

Market Update Summary (June 2020):

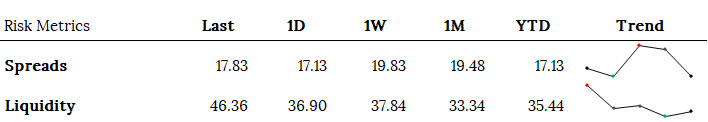

- When we look at risk indicators, we take into account both the data and what’s happening on the ground in communities to give us a better ability to interpret the meaning and implications of the risk in the system.

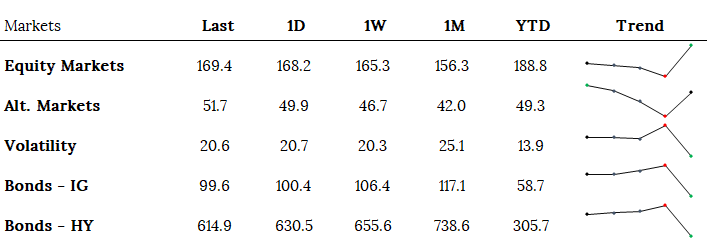

- Risk indicators have come down following Fed’s widespread intervention. We continue to hold that significant risk remains in the system until we fully understand how the economy integrates once federal stimulus supports are removed.

- The Fed intervened again this past week with a billion dollar support to buy up struggling corporate bonds, so we are still far from witnessing an economy that can stand on its own without federal support.

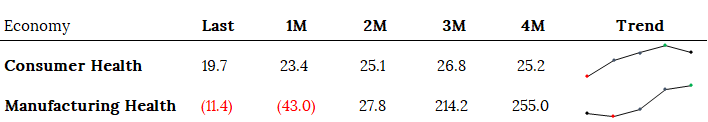

- The public education sector is just one of the many that is struggling to re-emerge in our current economy. Widespread budget deficits are creating drastic plans for closures, workforce reduction and costly safety protocols that will impact communities across the country.

- We are calling for federal intervention not just in the corporate space but in the municipal space as well to help ease the impact on our communities and not just massive corporations. The fed did offer municipal support in earlier stimulus packages so we hope this is still on their mind.

- We take a peek at what the data is showing for COVID-19 cases, testing and fatality trends in the US.

- We believe the biggest risk in the system is unemployment, as the data is still significantly elevated. Unemployment assistance ends at the end of July and we are paying close attention to what will happen to all of these people and how the economy will respond.

- Large companies are performing best right now. Just 5 companies, referred to as FAAMG, are up 23%. However if you remove those 5 companies, the entire rest of the S&P 500 is down. This was a trend we pointed out last month and it continues to play out. This trend causes confusion in the markets as it sends a signal that the system is stronger than it really is.

- We’ve taken on new positions, as our clients know, and continue to look for strategic opportunities to capture value in market movements. We like how the technology sector is playing out and feel this will continue to be a strong sector into the future.

- We are not rushing to re-enter the market. A few successful companies does not point to an overall healthy market system or a solid economy. We believe we are stronger keeping a cash cushion, especially moving towards September.

- There tends to be a liquidity/cash crunch in the markets as we approach September. If a second wave of a pandemic hits around this same timing, we expect to see a negative impact on markets.

We hope everyone is doing well. We continue to monitor and research the current conditions and future outlook diligently. We are always available to discuss your portfolio or your individual situation. Please contact us with any questions or to set up a meeting.

Best regards,

The Willow Team

+1 413 236 2980