March 30, 2020

Is the Bull Market already back? Alexandra and Paul team up to explain why we don’t think so! In today’s video market message for the Willow community, Alexandra and Paul share insights, analysis and outlook on current market and economic conditions.

Video Highlights:

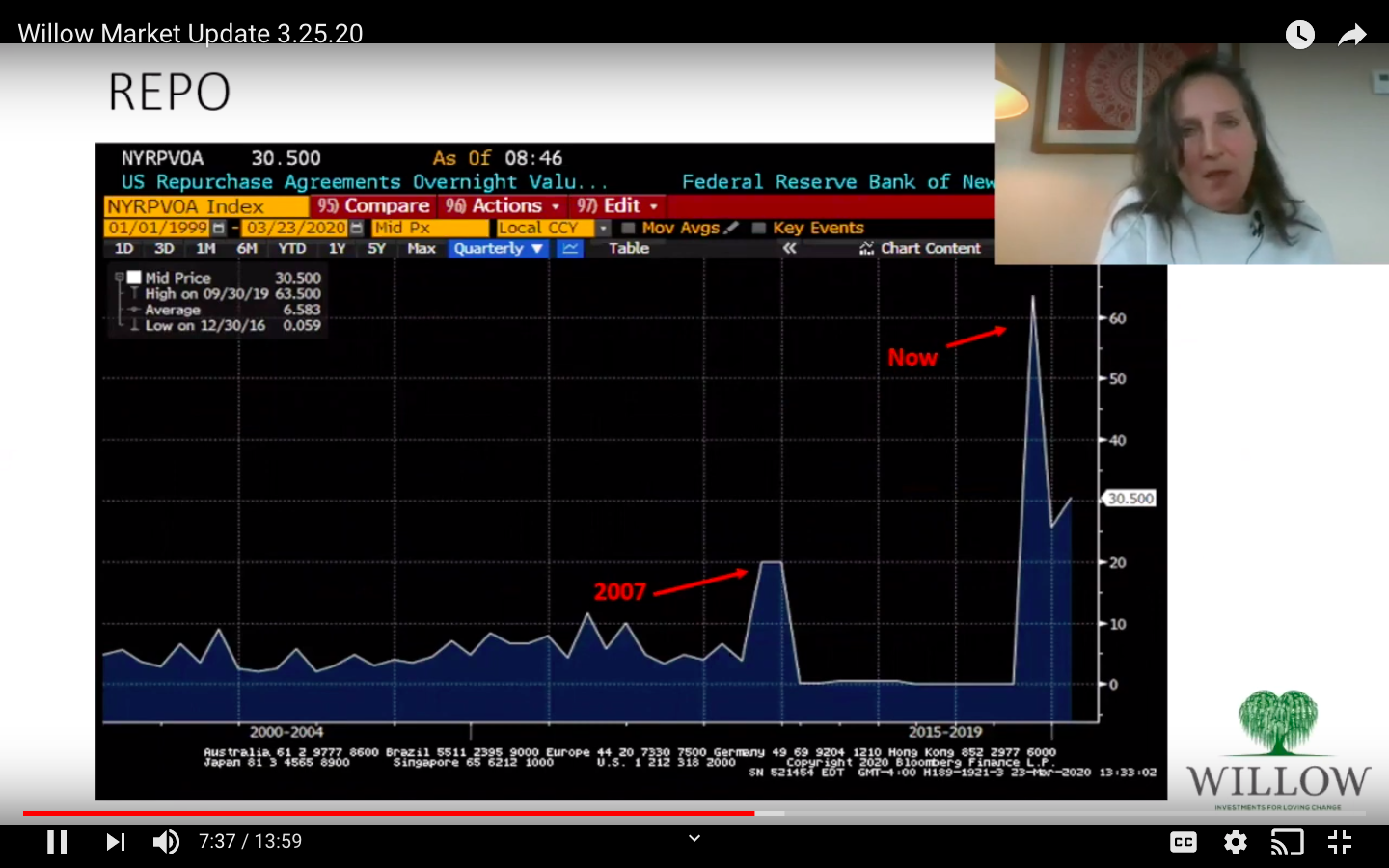

– After a big market drop, it’s typical to get a “bounce” that could be as much as 50% of the previous high. While it might look like the market is returning, we’ll show you why we don’t believe a “V” recovery is possible right now.

– With low consumer confidence (consumer makes up 70% of the market), high unemployment and still unknown toll of Coronavirus, we are not seeing any signals that the market is ready for a turnaround quite yet.

– We make moves based on data, not hope or hype. We continue to stay conservative and defensive.

– Right now we like sectors such as tangible assets (water infrastructure, farmland, etc), necessities (utilities, consumer staples) and technology (cloud computing, remote tech/remote health care).

– We continue to encourage leaders to see this as an opportunity to bring our existing structures into question and rebuild systems that are more equitable, sustainable and conscious.

As always, a deep bow of gratitude to you our clients. Please don’t hesitate to contact us with any questions or concerns.

Best regards,

The Willow Team

+1 413 236 2980