Willow Risk Monitor July 2020

Welcome to the July 2020 overview edition of the Willow Risk Monitor, where we share our analysis of the level of risk in the current market across a variety of metrics. We also explain our thinking on how we look at and assess overall market risk, and we will often highlight what the data shows compared to what you might be hearing in the news.

Please contact us if you have any questions or if there is something you’d like more detail about. We welcome your feedback!

To learn more about the premium version of the Willow Risk Monitor, click here.

Consumer Health (proprietary algorithm)

The good news is, for now, it looks like a bottom has been found. Many of the individual data points are starting to turn positive or at least the velocity (the steepness of the curve) has leveled out and we’re seeing some flattening. An interesting take away here is the changes occurring in consumer credit, Americans have shifted in a big way to savings – with consumer credit outstanding dropping massively, it will be important to see if this rebounds as lock downs ease, or if a fundamental shift has taken place altering consumer spending patterns on a more permanent basis.

Risk Assessment: High. While things for many are uncertain, Government benefits have undoubtedly eased the pain but their continuation is not guaranteed and is set to change the end of this month. Millions are still jobless and while some jobs are coming back many, especially small businesses, are not expecting to rehire everyone they lost.

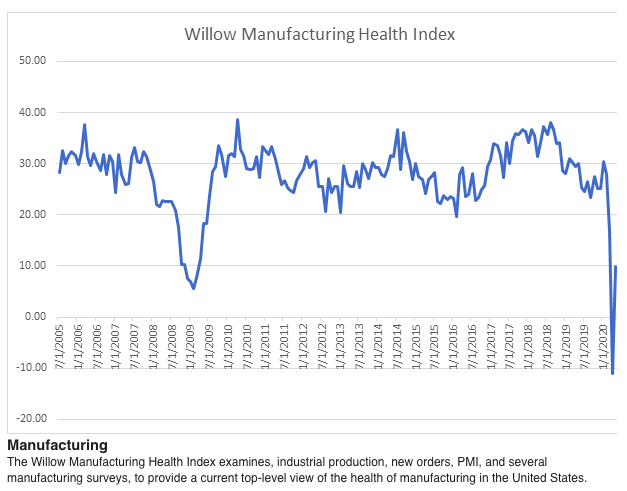

Manufacturing Health (proprietary algorithm)

While steepness of the “recovery” here is worth noting, it should be taken with a grain of salt. It looks to be mostly driven by a huge increase in PMI (the Purchasing Manager Index) which is based on a monthly survey of supply chain managers. There seems to be a lot of hope baked into this rise but in looking at other components of the manufacturing sector many metrics have flattened or only slightly risen from their bottom.

Risk Assessment: High. The pop-up from the bottom is great to see and definitely a positive but there is not enough data yet show this sector of the economy is out of the woods. To compound things, trade deals, trade wars, supply chain disruptions, increased automation… the list of items poking this sector is long…

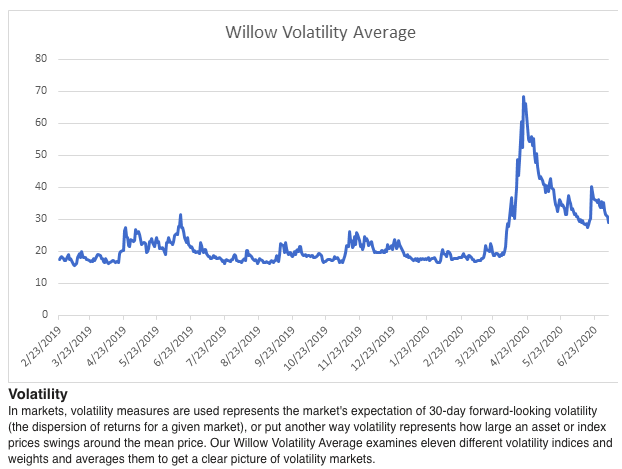

Market Volatility (proprietary algorithm)

While volatility has come down considerably from its March peak, levels still remain elevated across the board. The direction is certainly positive, but the velocity has slowed, and the sustained higher-than-average levels warrant the need for caution.

Risk assessment: Medium.

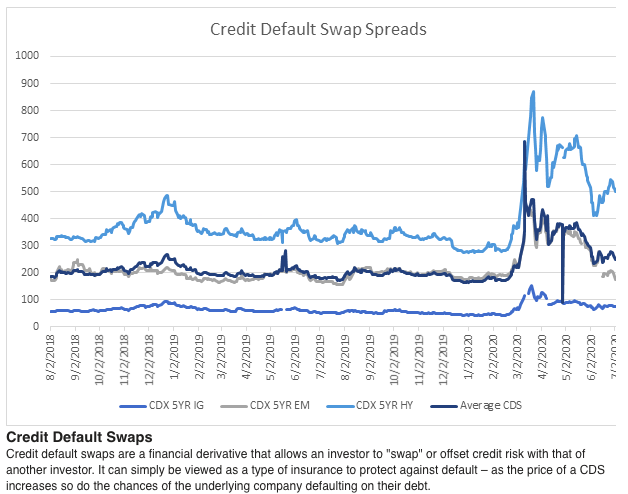

Credit Default Swap Spreads

CDS Levels have remained elevated but continue to track down, which is positive. What keeps us watchful is that this tightening is mostly likely the result of government intervention, injecting capitol into companies to prevent defaults. But for now, the direction is right, and the levels seem to be normalizing here. Worth understanding though is that at these levels we would expect to and are seeing some bankruptcies to start trickling in.

Risk assessment: Medium.

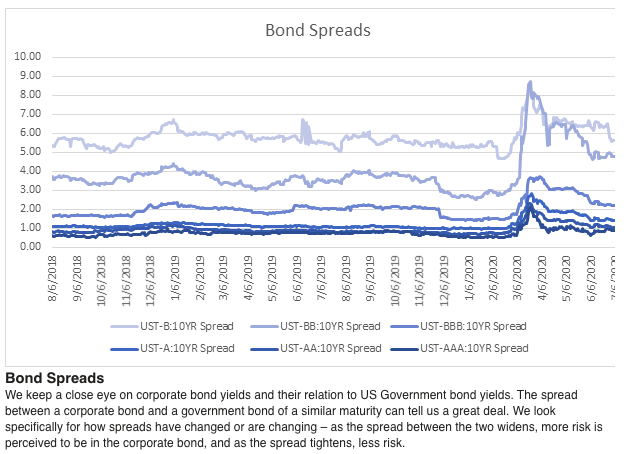

Bond Spreads

Things have settled down, and almost completely returned to normal for top rated investment grade companies. Higher yield or junk bonds spreads, while tightening some, are still wide – meaning risk in these markets is still very much alive.

Risk Assessment: Medium/Low. Actions of the Fed have taken some of the pressure off debt markets as they expands their balance sheets with bond ETF purchases and the purchase of actual bonds from individual companies. While we believe there are some very apparent conflicts of interest here and questionable ethics are taking place, these moves have stabilized these markets for time being.

As always, be well and please feel free to reach out with any questions, comments or concerns.

Best regards,

The Willow Team

+1 413 236 2980

ADCM, LLC dba Willow does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although the information contained herein has been obtained from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to buy or sell securities.